It seems that every new year brings the same question - "Tom: what are your projections for the upcoming year? Is the market going to be up or down?"

I am entering my twenty-seventh year as a professional practitioner in, and perpetual student of, investing. I know that the market has historically been positive three out of four years, but this doesn't make my answer any easier. Every year will feel different; therefore, I don't take my reply lightly.

I've learned that many questions about the future or about volatility are essentially fear-driven, that investing is a very emotional endeavor, and that any thorough response requires me to be an educator first. Among the most important lessons about investing that I can impart are

- To understand your own investment time horizon,

- That there is no connection between this time horizon and short-term changes in price,

- And that knowledge about the short term does not, will not, and cannot, translate into wisdom about the long term.

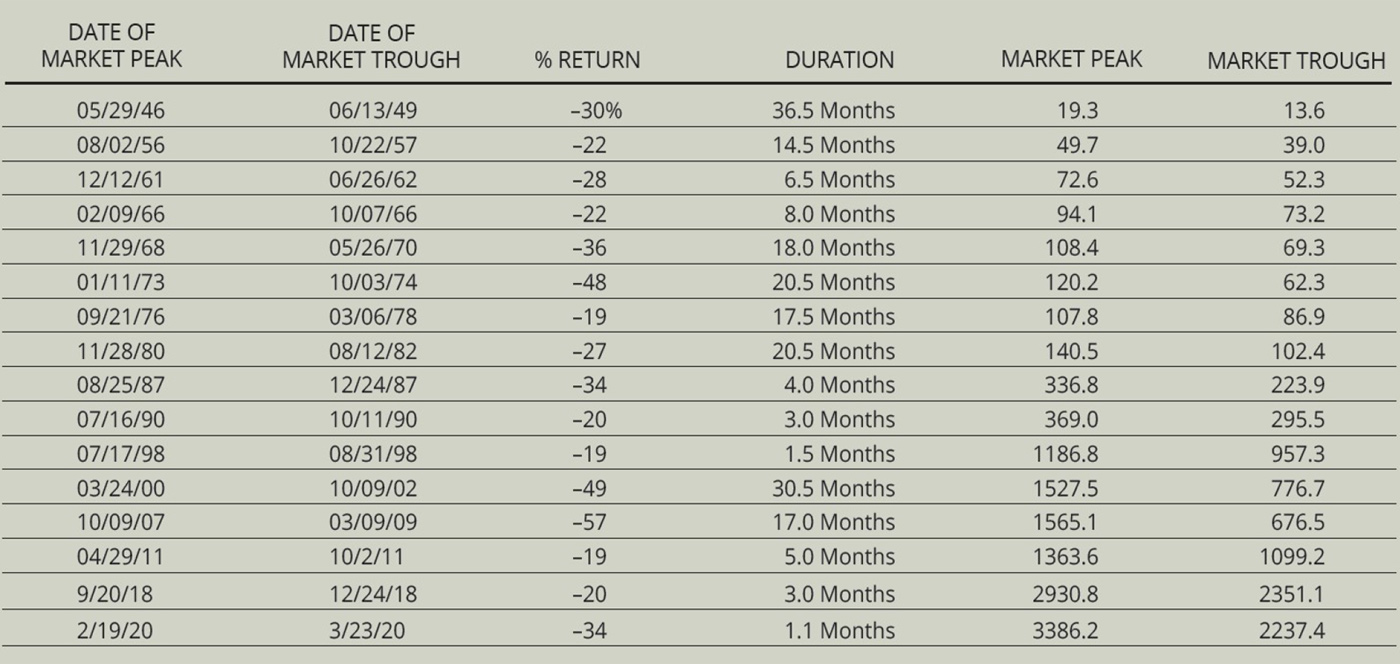

Let's consider some of the evidence to support these views. The following chart lists the most severe pullbacks in the history of the S&P500 from 1926 to 2020.

On top of this list of "Greatest Hits", consider also that the average annual intra-year decline of the S&P500 from 1980 to 2020 is -14.3%. In the context of this perennial pummeling, one might rightly wonder what the likelihood is of any long-term investor coming out ahead. Fortunately, I can provide that data as well:

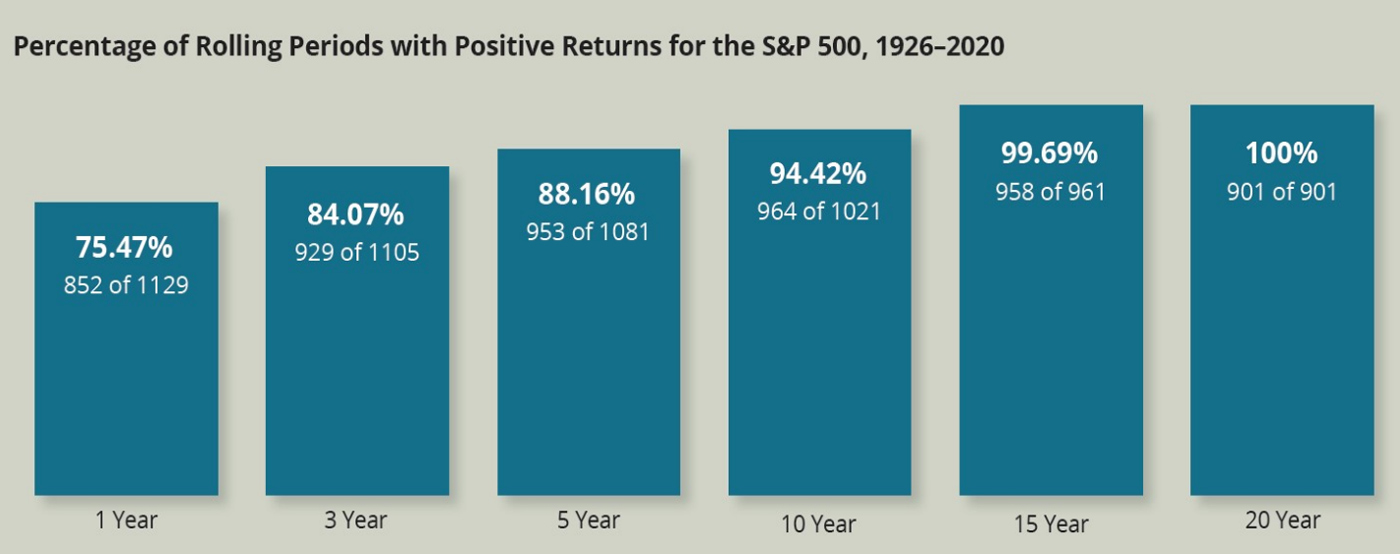

It is easy to recognize that, with the added ingredient of Time, a patient investor has an incredible likelihood of realizing a positive outcome. Just imagine if you went to the Vegas Strip and knew you had those odds before entering a casino! Also imagine that your investment results over the NEXT 5, 10, 15 and 20 years might resemble something similar. Would you take it?

Not coincidentally, the observation periods in the second chart above correspond nicely with the typical investor's long-term investment time horizon.

Oddly, there seems to be more optimism and enthusiasm shared over a small win at the slots than prudently investing your life's hard-earned savings into the best companies inside the best country on the planet, and simply not making changes until you needed it. Imagine the amount of risk and stress you could have reduced or nearly eliminated. Imagine the difference you could have made financially by not allowing venomous thoughts impair your investment judgement to the point of forcing a bad decision – and we have all made them to one degree or another.

The Riddle of Investing is how to withstand the near-constant short-term corrections and Bear Markets in order to benefit from the long-term Bull Market. The preservation of this invaluable long-term perspective in the face of the noise and emotional shocks of every day life is the essence of successful investing outcomes.

(Referring back to the first chart one last time: The S&P500 Index is at around 3900 as of early 2021. That means that for the period from January 1, 1946 through December 31, 2020, the S&P500 has had a total return of 232,632.22%. With dividends reinvested, a $10,000 investment then would have grown to $23,273,222.37 by now. In other words, enormous wealth would have been the long-term reward of tolerating every single evidently-catastrophic downturn in the market since then and not losing one's nerve.)

So, I will end with the prevailing question - Are we going to have a correction?

The honest and candid answer is no one really knows if, when, and to what extent. Hopefully, it is also clear that – where long-term success in investing is the objective - predicting the next correction is not necessary, useful, or constructive.

"Seek wisdom, not knowledge.

Knowledge is of the past, Wisdom is of the future."

-American Proverb

It will always be uncomfortable to not know what is going to happen in the near future. However, the uncertainty of short-term outcomes is the price that we must willingly pay in order to maximize long-term outcomes. The commencement of investing wisdom is the realization that long-term outcomes are the only ones that matter.

As the months turn into years, and the years into decades, we will undoubtedly experience more pullbacks and volatility in the course of pursuing our cherished financial goals. Some of these may be extremely worrying in the short-term. These times are not only inevitable, but they are how markets essentially work. I will say now – and will remind you then – that your plan is designed with this truth in mind, that we will get through it, and that wealth most likely awaits those who stay the course.

Here's to a healthy and prosperous new year!

Your friend and advisor,

Tom Udovich, CFP®

Partner, Acadium Financial Partners

3601 PGA Boulevard, Suite 301

Palm Beach Gardens, FL 33410

Any opinions are those of Tom Udovich are not necessarily those of Raymond James. Securities offered through Raymond James Financial Services, Inc. member FINRA/SIPC. Acadium Financial Partners is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.